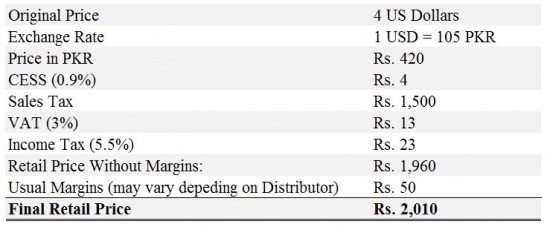

With the implementation of various taxes, the mobile phone costing $4 can cost in Pakistan for Rs.2,010.

Explanation of Taxes:

CESS: CESS is the tax, which is applied for the transportation of the goods within Punjab or through from it. If the purchases are made in Sindh or other provinces, then this tax is not legible on these products.

Sales Tax: sales tax is applied on different kinds of products and in the budget of this year, this sale tax is doubled. The sales tax on the smart phones is Rs.500, Rs.1000 or Rs.1500, which depends on the specifications of the mobile phone. On the basis of the specification of the smart phone for $4, the sales tax is applied to Rs.1500.

VAT: On the import of all categories of smart phone, the 3% VAT is applicable on these handsets.

Income Tax: On the import of all categories of smart phone, 5.5% Income tax is applicable on these handsets.

Points to ponder:

Telecom sector is the leading sector, which is generating taxes in Pakistan and the government is still increasing the tax rates in this sector. When these taxes reach to the threshold level, then they start impacting on the industry negatively and as well as on the customers. When the tax level is reached to the highest point in Pakistan, then it will decline the revenue for private sector and also on the declined tax collection for the government sector during 2014-15.

Despite of the negative impact of taxes on telecom sector, the government does not stop increasing the tax level on the telecom sector. The taxes on the feature phones or smart phones are increased this year too.

The government has increased the internet adoption to 10%, which results in GDP growth of 0.04 percent to 1.5% in the emerging market and it has great impact on the industry. The concerned authorities should consider the implementation of undue taxes on the mobile phones and in the telecom sector, they are increasing the entry barrier for masses and it also results in the negative manner for the national economic growth.

There are different types of the researches have been made in the national and international agencies or institutes and they suggest that implementation of the taxes in telecom sector can stop the growth rate of the country. The leaders will get this point and they should think over the long term goal rather than the short term goals.